📋 TL;DR — Quick Summary (Click to Expand)

Regular IRAs hold paper assets like stocks and bonds. Gold IRAs hold physical precious metals in IRS-approved depositories. Each serves a different function in a retirement portfolio. Regular IRAs have historically delivered higher long-term returns during stable economic periods. Gold IRAs have historically shown low correlation with equities during periods of market stress. Financial planners commonly suggest holding both asset types rather than choosing one. Fees, liquidity, and time horizon all factor into the decision. This content is for educational purposes only. Consult a licensed financial professional before making investment decisions.

The federal employee with 30 years in, watching his TSP balance grow on paper while wondering if it will buy half as much when he finally retires. You served the government. The government’s money policy shouldn’t erode what you earned.

📑 Table of Contents (Click to Expand)

- What Makes Them Different

- Regular IRA Strengths and Weaknesses

- Gold IRA Strengths and Weaknesses

- Head-to-Head Comparison Table

- Historical Performance by Economic Period

- Fee Comparison: What Each IRA Costs

- Age and Timeline Considerations

- Using Both IRA Types Together

- Red Flags in Both IRA Spaces

- Frequently Asked Questions

- Final Word

What Makes Them Different

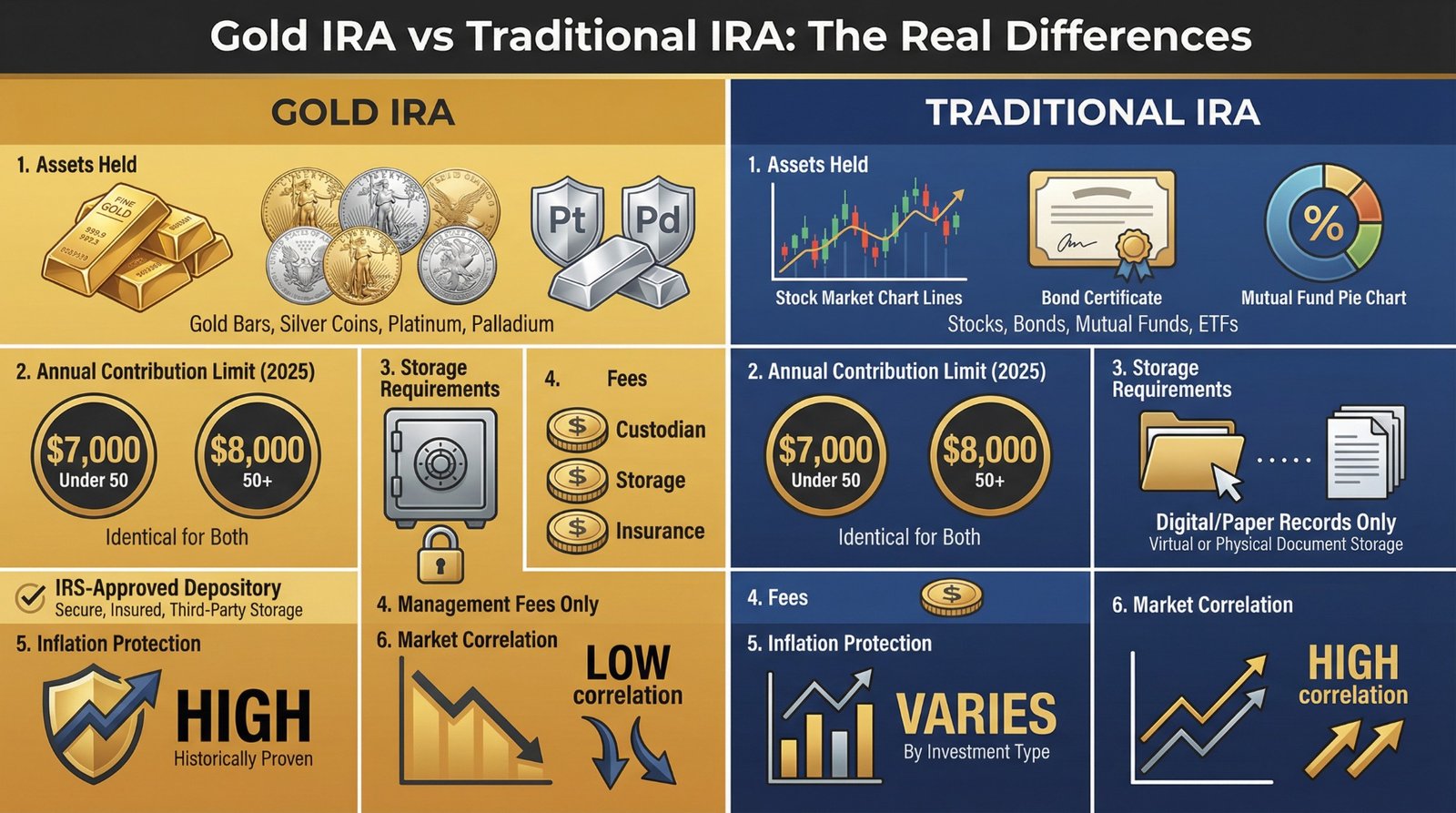

The Regular IRA vs Gold IRA question starts with a simple distinction. Both are tax-advantaged retirement accounts governed by the same IRS rules. The difference is what sits inside them.

Regular IRAs hold paper assets. Stocks, bonds, mutual funds, ETFs. Your wealth exists as digital entries at a brokerage. Value rises and falls with market conditions.

Gold IRAs hold physical precious metals. Gold bars, silver rounds, platinum coins. Stored in IRS-approved depositories. Value moves independently from stock markets.

Same tax structure. Same contribution limits. Same IRS penalties for early withdrawal. Different underlying assets with different behavior patterns during different economic conditions.

For a complete foundation on precious metals retirement accounts, see our guide on what is a Gold IRA.

The bottom line: This comparison uses historical data and IRS rules. It reports what happened. It does not predict what will happen next.

Regular IRA Strengths and Weaknesses

Regular IRAs have been the standard retirement vehicle for decades. They deliver measurable advantages in certain conditions and carry specific risks in others.

Strengths

Growth potential. The S&P 500 averaged 10.26% annually from 1926 to 2023, according to historical market data. Compounding turns modest contributions into substantial balances over 30-year periods.

Income generation. Stocks pay dividends. Bonds pay interest. That income compounds inside the account. Physical metals generate zero income.

Liquidity. Sell a stock position and cash settles in one to two business days. Fast access when needed.

Low fees. Index fund expense ratios run as low as 0.03%. Total annual costs on a $100,000 account typically range from $50 to $200.

Employer matching. Many 401(k) plans offer contribution matching. Those funds can later roll into a Regular IRA. Gold IRAs do not receive employer matches.

Diversification options. One account can hold thousands of stocks, bonds, REITs, and international funds.

Weaknesses

Market correlation. During systemic events, asset classes that normally move independently can decline together. In 2022, both stocks and bonds posted negative returns simultaneously.

Sequence-of-returns risk. A major decline in the years just before or after retirement can permanently reduce portfolio longevity. Timing matters more than averages.

Inflation exposure. Account balances are denominated in dollars. When the Bureau of Labor Statistics reports rising CPI, purchasing power of those dollars declines regardless of nominal account value.

Counterparty dependence. Value depends on the solvency of companies, governments, and financial institutions. No physical asset backs the holdings.

The practical takeaway: Regular IRAs deliver strong long-term returns in stable conditions. They carry concentration risk when the entire financial system faces stress at once.

Gold IRA Strengths and Weaknesses

Gold IRAs hold physical precious metals stored in IRS-approved depositories. Same tax treatment as Regular IRAs. Different asset, different behavior.

Strengths

Low equity correlation. Gold has historically shown low or negative correlation with stock markets during periods of financial stress. This is one reason central banks maintain gold reserves, according to the IMF.

Purchasing power track record. Gold has maintained purchasing power across centuries. An ounce bought comparable goods in ancient Rome, in 1920, and today. Currencies change. The metal does not.

No counterparty dependence. Physical gold in a vault does not require a company to stay solvent, a government to honor bonds, or a bank to remain liquid.

Portfolio volatility reduction. Adding a non-correlated asset to a stock-heavy portfolio has historically reduced overall portfolio volatility, according to modern portfolio theory.

IRS tax treatment. Gold IRAs follow the same IRS rules as Regular IRAs, as outlined in IRS Publication 590-A. Traditional versions offer tax-deferred growth. Roth versions follow Roth rules.

Weaknesses

Zero income. Gold generates no dividends, interest, or cash flow. Returns come only from price appreciation at time of sale.

Higher fees. Physical storage, insurance, specialized custodians. Annual costs typically run $200 to $600 versus $50 to $200 for Regular IRAs.

Lower long-term returns in bull markets. From 2013 to 2023, the S&P 500 returned approximately 12.75% annually while gold returned approximately 4.57%. Over extended growth periods, stocks outperform metals significantly.

Slower liquidity. Selling physical gold takes three to ten business days from sale approval to funds transfer. Stocks settle in one to two days.

Storage restrictions. IRS rules require Gold IRA metals to remain in approved depositories. Home storage is not permitted and triggers taxes plus penalties.

Minimum threshold. Annual fees make Gold IRAs impractical below $25,000. Fixed costs of $200 to $400 consume too much return on smaller balances.

Regular IRA vs Gold IRA: same tax structure, different underlying assets with different behavior patterns

Why this matters: Gold IRAs serve a different function than Regular IRAs. One optimizes for growth. The other has historically shown resilience during periods when growth assets declined.

Regular IRA vs Gold IRA: Head-to-Head Comparison

Eight categories that matter for retirement planning. This Regular IRA vs Gold IRA table presents historical data and structural differences without declaring a winner.

| Category | Regular IRA | Gold IRA |

|---|---|---|

| Long-Term Returns | Historically 8-10% annually (balanced portfolio) | Historically 4-8% annually depending on time period |

| Crisis-Period Behavior | Historically declines with broader market | Historically low or negative correlation with equities |

| Inflation Track Record | Variable; depends on asset mix and conditions | Historically maintained purchasing power over long periods |

| Income Generation | Dividends and interest compound tax-deferred | Zero income; returns from price appreciation only |

| Annual Fees | $50-$200 (index fund approach) | $200-$600 (custodian + storage + insurance) |

| Liquidity Speed | 1-2 business days | 3-10 business days |

| Counterparty Risk | Depends on issuing companies and institutions | Physical asset; no counterparty required |

| Minimum Practical Balance | No practical minimum (fees scale with balance) | $25,000+ (fixed fees eat smaller balances) |

Past performance does not guarantee future results. This table reflects historical data and structural characteristics, not predictions.

Here’s the real impact: Neither IRA type dominates every category. They serve different functions. The decision depends on individual circumstances, risk tolerance, and time horizon.

Historical Performance by Economic Period

Theory is useful. Historical data is better. Here is how these asset classes actually performed during real economic events. All figures are approximate and sourced from publicly available market data.

2008 Financial Crisis

The S&P 500 declined approximately 37%. Gold appreciated approximately 5.8%. A $100,000 Regular IRA became roughly $63,000. A $100,000 Gold IRA became roughly $105,800.

Investors within five years of retirement faced difficult recovery timelines. Full recovery of the S&P 500 took approximately four to five years for those who remained invested.

2013-2023 Growth Period

The S&P 500 returned approximately 12.75% annually. Gold returned approximately 4.57% annually. A $100,000 Regular IRA grew to roughly $330,000. A $100,000 Gold IRA grew to roughly $156,000.

During extended periods of economic stability and low inflation, equities have historically outperformed metals by a significant margin.

2020 COVID Disruption

The S&P 500 dropped 34% in 33 trading days. Gold gained approximately 25% for the full year. Markets recovered rapidly after unprecedented fiscal stimulus, but the 33-day drawdown exposed the speed at which paper asset values can change.

2022 Inflation Period

The S&P 500 declined approximately 18%. Bonds, traditionally a counterweight to stocks, also declined roughly 13%. Gold held relatively flat, then appreciated 13.1% in 2023 as inflation concerns persisted. This was the first period in decades where stocks and bonds declined simultaneously.

The pattern in the data: Gold has historically performed well during periods of financial system stress and currency instability. Equities have historically performed well during periods of economic growth and stability. Neither has dominated across all conditions. Past performance does not guarantee future results.

For a deeper look at gold performance across decades, see our guide on gold investment over time.

Translation: Historical data shows these asset classes perform differently in different economic conditions. The relevant question is which conditions you expect to encounter during your retirement timeline. Nobody can predict that with certainty.

📊 See How Gold Performed Over Time

🎯 Free Download: Retirement Rescue Gold IRA Playbook

Complete guide to understanding precious metals in retirement accounts. Includes fee worksheets, rollover checklists, and IRS rules reference.

Fee Comparison: What Each IRA Costs

Fees compound against you the same way returns compound for you. A 1% difference in annual fees can significantly affect a portfolio over 20 to 30 years. Understanding the Regular IRA vs Gold IRA fee structure is essential.

Regular IRA Annual Costs (on $100,000)

Management fees typically run 0.03% to 1.0% of account value. Transaction fees range from $0 to $50, depending on the brokerage. Total annual cost: approximately $50 to $1,000.

Gold IRA Annual Costs (on $100,000)

Custodian fees run $75 to $300 annually. Storage and insurance run $100 to $300 annually. Transaction fees range from $40 to $75 per buy or sell. One-time dealer markup of 1% to 5% over spot price at purchase. Total annual cost: approximately $200 to $600, plus one-time markup.

The Break-Even Math

Gold IRAs need approximately 0.5% to 1.0% higher annual returns just to match Regular IRA performance after fees. On accounts below $25,000, fixed fees of $200 to $400 represent 1.6% or more of the balance. That overhead makes small Gold IRAs impractical.

At $100,000 or above, fee impact drops to 0.2% to 0.6% of account value. The economics improve with scale.

For your portfolio: Run the fee math on your specific balance before making any IRA decision. Fees are certain. Returns are not.

Age and Timeline Considerations

Time horizon changes the math on every investment. Financial literature consistently identifies age and proximity to retirement as primary factors in asset allocation decisions.

Longer Time Horizons (20+ Years to Retirement)

Investors with decades until retirement have historically recovered from market downturns. Time reduces the impact of short-term volatility. Financial literature generally emphasizes growth-oriented assets for long time horizons.

Medium Time Horizons (10-20 Years)

This range introduces sequence-of-returns risk. A major decline in the final decade before retirement can permanently reduce portfolio value. Financial planners commonly discuss adding non-correlated assets at this stage to reduce portfolio volatility.

Short Time Horizons (Under 10 Years)

Preservation of existing capital becomes increasingly important as retirement approaches. The 2008 decline demonstrated what a 37% drawdown means for someone five years from retirement. Financial literature describes this period as the “fragile decade” for portfolios.

For a broader comparison of retirement asset classes, see our analysis of gold IRA vs stocks vs cash.

How this benefits preppers: Your time horizon matters more than any single asset class decision. A licensed financial advisor can help determine the right allocation for your specific situation.

Using Both IRA Types Together

The Regular IRA vs Gold IRA framing implies a binary choice. Financial literature suggests otherwise.

Modern portfolio theory, developed by Nobel laureate Harry Markowitz, demonstrates that combining assets with low correlation to each other can reduce overall portfolio volatility without proportionally reducing returns.

Industry surveys show financial planners commonly cite 5% to 15% as a typical precious metals allocation range. Individual circumstances vary widely. Age, income, existing assets, and personal risk tolerance all factor into the equation.

How the IRS Allows It

The IRS permits individuals to hold multiple IRA accounts simultaneously. A Regular IRA at one custodian and a Gold IRA at a specialized custodian is permitted under IRS retirement account rules. Combined annual contributions must stay within IRS limits across all accounts.

For step-by-step transfer details, see our Gold IRA rollover guide.

The bottom line: The IRS allows holding both. The allocation question depends on your individual situation. Consult a licensed financial professional for personalized guidance.

Red Flags in Both IRA Spaces

Bad actors operate on both sides. Know the warning signs before committing money.

Regular IRA Red Flags

Excessive expense ratios. Anything over 1% annually for managed funds deserves scrutiny. Index alternatives often deliver comparable or better results at a fraction of the cost.

Overconcentration. All assets in one sector means unnecessary risk. Diversification within asset classes matters.

Churning. Excessive buying and selling that generates commissions without improving performance. Review trade frequency against actual returns.

Gold IRA Red Flags

“Home storage” schemes. The IRS does not permit home storage of Gold IRA metals. Any company promoting this is misrepresenting IRS rules. See IRS guidance on collectibles in retirement accounts.

Rare coin pressure. Dealers pushing numismatic or collectible coins over standard bullion are chasing higher margins. Bullion carries lower markup and better liquidity.

Hidden fees. Legitimate custodians publish fee schedules. If a company will not disclose all costs in writing before you commit, walk away.

High-pressure sales. “Act now” urgency signals commission-driven behavior. A legitimate retirement decision deserves deliberate research.

For a comparison of top Gold IRA companies and the custodians they work with, see our Gold IRA company reviews.

⚠️ FTC Reminder: No investment is guaranteed. Any company claiming “guaranteed returns” or “risk-free” precious metals investing is misrepresenting reality. Verify all claims independently before committing funds.

The practical takeaway: Due diligence applies equally to both Regular IRA and Gold IRA providers. Skepticism is free. Recovery from a bad decision is not.

📋 FAQ (Click to Expand)

Can I convert my Regular IRA into a Gold IRA?

Yes. The IRS permits direct trustee-to-trustee transfers from a Regular IRA (Traditional or Roth) into a Gold IRA without triggering taxes or penalties. Your Gold IRA custodian coordinates with your current custodian. Transfers typically take 7 to 14 business days.

Do I pay taxes when moving money between IRA types?

Not if done as a direct trustee-to-trustee transfer. The IRS treats this as a non-taxable event per Publication 590-A. Taking personal possession of funds and failing to complete the rollover within 60 days triggers taxes plus a 10% early withdrawal penalty for those under 59 and a half.

Can I hold both types in the same account?

No. Regular IRAs and Gold IRAs require separate accounts with different custodians. Traditional brokerages like Vanguard and Fidelity do not handle physical metals. Gold IRAs require specialized custodians with depository relationships. You manage allocation strategy across both accounts.

What if I change my mind after opening a Gold IRA?

You can sell the gold and transfer cash back to a Regular IRA without tax penalties as a trustee-to-trustee transfer. However, dealer markups at purchase (1% to 5% over spot) and selling spreads (1% to 3% under spot) create a round-trip cost of 2% to 8%. Gold must appreciate beyond that spread before any transfer back reaches break-even.

How do Required Minimum Distributions work for each?

Both Traditional Regular IRAs and Traditional Gold IRAs require RMDs starting at age 73 per current IRS rules. Roth accounts of both types have no RMDs during the owner’s lifetime. For Gold IRAs, most owners have the custodian sell metal and distribute cash rather than taking physical possession, which would trigger a taxable distribution event.

Which performs better during recessions?

Historical data shows gold has outperformed equities during several major recessions. Gold appreciated 5.8% during 2008 while the S&P 500 declined 37%. Gold gained 25% during 2020. However, not all recessions produce the same result. Performance depends on the specific drivers of each downturn. Past performance does not guarantee future results.

Is one “safer” than the other?

“Safer” depends on which risk concerns you. Gold IRAs carry no counterparty risk since you own physical metal. Regular IRAs carry no storage risk and offer faster liquidity. Gold has historically held value during currency instability. Stocks have historically delivered superior growth during stable periods. They address different risks. Neither eliminates all risk.

Which should I open first?

Financial planners generally recommend establishing a Regular IRA first to build foundational retirement savings and capture any available employer matching. Once a base is established, adding a Gold IRA for non-correlated exposure is a separate decision based on individual circumstances. Consult a licensed financial advisor for guidance specific to your situation.

What is the minimum for a Gold IRA to make sense?

Most financial analysis suggests $25,000 as a practical minimum. Below that threshold, annual fees of $200 to $600 consume 1.6% or more of account value. At $50,000 or above, fee impact drops to under 1%, making the economics more favorable.

Can I take physical possession of gold from my IRA?

Yes, but the IRS treats it as a distribution. You owe taxes on the fair market value of the metal, plus a 10% early withdrawal penalty if under 59 and a half. The gold leaves your tax-advantaged account permanently. If you want gold you can hold, purchase it outside your IRA with after-tax dollars.

Final Word

The Regular IRA vs Gold IRA decision is not about picking a winner. It is about understanding what each tool does.

Regular IRAs have delivered strong returns during periods of economic growth and market stability. Gold IRAs have historically shown resilience during periods when traditional assets declined together. Neither dominates in all conditions. Historical data makes that clear.

The right approach depends on your age, your timeline, your existing holdings, and your personal tolerance for risk. Those factors are individual. No article can make that decision for you.

Do the research. Run the fee math on your balance. Consult a licensed financial professional who understands your full picture. Then make your own call.

This content is for educational purposes only. It does not constitute financial, tax, or investment advice. Consult licensed professionals before making investment decisions.

— The PreppersGoldIRA Team

You built your business with your hands. Signed the loans yourself. Made payroll when it hurt. You didn’t build that on IOUs. Why would you build your retirement on them? Read everything. Question everything. Then make your own call.

📚 Related Resources

- What Is a Gold IRA — Complete foundation for precious metals retirement accounts

- Gold IRA Rollover Guide — Step-by-step 401(k) transfer process without penalties

- Best Gold IRA Companies — Top-rated companies and the custodians they partner with

- Gold IRA vs Stocks vs Cash — Broader asset class comparison for retirement

- American Gold Eagle Review — The most common IRA-eligible gold coin explained

📋 Legal Information

For complete transparency and your protection, please review:

- Terms of Service — Rules governing use of this website

- Disclaimer — Important limitations on our content and advice

- Privacy Policy — How we protect and use your information

- Affiliate Disclosure — How we earn commissions

These pages are part of our commitment to full transparency and legal compliance.